Equity dilution explained sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset.

This concept is crucial for businesses as it directly affects ownership stakes and the overall value of shares. Equity dilution occurs when a company issues additional shares, resulting in a decrease in existing shareholders’ ownership percentages. This can happen in various contexts, such as during funding rounds, mergers, or acquisitions, making it essential for stakeholders to understand its implications in both startup and established companies.

Understanding Equity Dilution

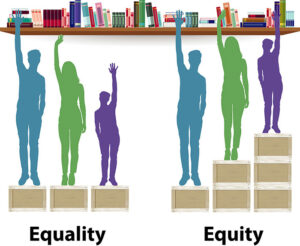

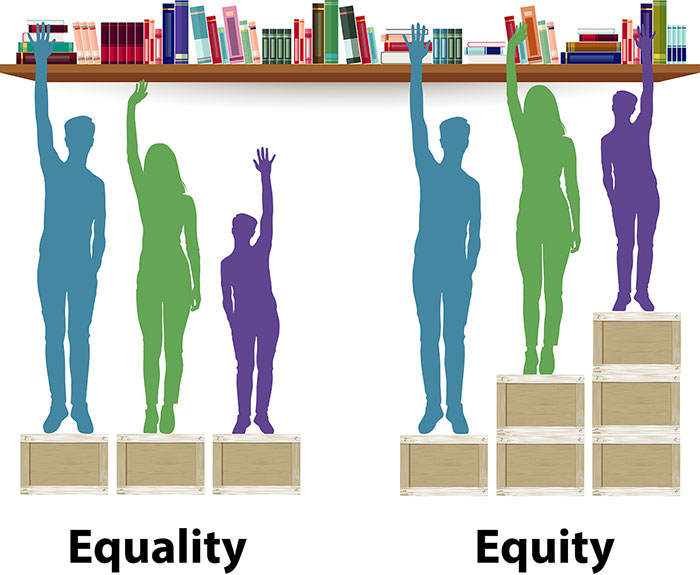

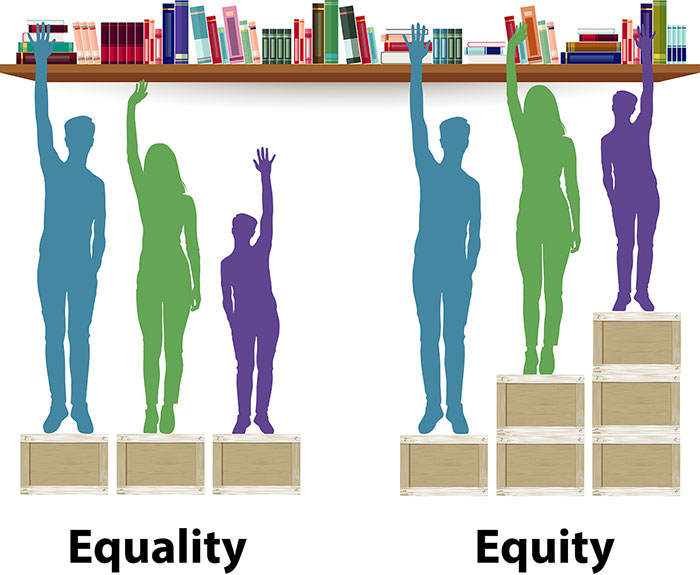

Equity dilution is a term that refers to the reduction of existing shareholders’ ownership percentage in a company when new shares are issued. This concept is particularly significant in the world of business, as it can impact control, decision-making, and the overall value of shares held by investors. Understanding when and how dilution occurs is crucial for both entrepreneurs and investors alike.Equity dilution can occur in several situations.

For instance, when a startup raises additional capital by issuing new shares to investors, existing shareholders may find their ownership percentage decreased. Another example includes employee stock option programs, where companies offer shares to employees as part of their compensation packages. This practice can lead to dilution as well. Existing shareholders may feel the impact of dilution negatively, as their voting power and profit share are reduced, potentially leading to dissatisfaction and concern over the company’s direction.

Causes of Equity Dilution

Several factors can lead to equity dilution within a company. Understanding these causes can help businesses navigate the potential pitfalls associated with issuing new shares.

- Issuing New Shares: The most direct cause of dilution is the issuance of new shares to raise capital. When a company decides to sell additional stock, the total number of shares increases, thereby reducing the ownership percentage of existing shareholders.

- Convertible Securities: Financial instruments like convertible bonds or preferred shares can also lead to dilution. When these securities are converted into common stock, they increase the total share count and dilute existing shareholders’ equity.

- Employee Stock Options: When companies grant stock options to employees, it can lead to future dilution. As these options are exercised, new shares are created, further increasing the total share count.

Equity Dilution in Startup Financing

Startups often encounter equity dilution during various funding rounds, which can be a double-edged sword. While raising capital is essential for growth, it often comes at the cost of diluting existing ownership.Startups can manage dilution during venture capital investments through several strategies. One effective approach is to negotiate favorable terms that limit the amount of equity given away in exchange for funding.

Additionally, seeking convertible notes or SAFE (Simple Agreement for Future Equity) agreements can delay dilution until the company has increased in value, benefiting existing shareholders.The effects of equity dilution can vary significantly between early-stage and later-stage startups. Early-stage startups might face more severe dilution due to high funding needs, whereas later-stage companies may have more leverage to negotiate better terms and mitigate dilution impacts.

Business Innovation and Equity Dilution

Innovation-driven companies often adopt a unique approach to equity dilution. These businesses are typically focused on rapid growth and may accept some level of dilution as a necessary trade-off for securing the resources needed to innovate and expand.Examples of innovative startups successfully managing dilution include tech companies that utilize strategic partnerships or joint ventures to raise capital without issuing new shares.

By aligning with other firms, they can access funds while minimizing the impact on shareholder equity.To balance growth and shareholder equity effectively, companies should implement best practices such as maintaining transparent communication with investors and employing strategic financial planning that prioritizes both innovation and equity preservation.

Equity Dilution and International Business

Equity dilution can manifest differently across various regulatory environments, affecting how companies operate internationally. Understanding these nuances is crucial for businesses planning to expand their reach beyond domestic markets.In some international markets, companies may face stricter regulations on equity financing, impacting their ability to raise capital without significant dilution. For example, firms in countries with rigorous foreign investment laws may struggle to secure funding without giving away a large portion of ownership.Case studies of companies like Uber and Airbnb illustrate the complexities of navigating equity dilution in international markets.

These firms experienced varying degrees of dilution based on local regulations and investor expectations.When comparing the impact of equity dilution in domestic versus international expansions, it’s clear that companies must carefully assess their strategies to protect shareholder interests while pursuing growth opportunities abroad.

Equity Dilution and Business Management

Effective management strategies can mitigate the effects of equity dilution. Leaders must communicate the implications of dilution clearly to stakeholders to maintain trust and transparency.Strategies for managing dilution include setting clear goals for fundraising that align with long-term business objectives and exploring alternative financing options that do not compromise equity. Additionally, companies can leverage tools and metrics to measure equity dilution, ensuring they remain proactive in managing their capital structure.Regular assessments of the equity situation can help businesses make informed decisions about future fundraising efforts while balancing the interests of both current and prospective investors.

Marketing Direct and Equity Dilution

Marketing strategies can significantly influence equity dilution, primarily through their impact on brand equity and shareholder value. A strong brand can enhance company valuation, potentially offsetting the negative effects of dilution.To align marketing efforts with shareholder interests, companies should focus on creating brand value that resonates with consumers while maintaining profitability. Effective marketing can lead to increased revenue, which can ease the dilution effects by enhancing the overall value of the company.Methods to achieve this alignment include targeting marketing campaigns that highlight the company’s unique value propositions and engaging with customers through multiple channels to strengthen brand loyalty.

Business Networking and Equity Dilution

Networking plays an essential role in raising capital for businesses without incurring significant equity dilution. Establishing strong relationships with potential investors can open doors to alternative funding sources that may not require giving up as much ownership.Tips for building relationships with potential investors include attending industry events, participating in pitch competitions, and utilizing online platforms designed for connecting entrepreneurs with backers.

Successful networking strategies can include maintaining ongoing communication with investors and leveraging existing relationships to secure introductions to new funding opportunities.Examples of companies that have successfully navigated funding rounds through networking include those that have built investor communities, allowing them to access capital while minimizing dilution.

Equity Dilution in the Restaurant Industry

The restaurant industry faces unique challenges regarding equity dilution. As many startups seek funding to establish or expand their operations, they often encounter the need to issue new shares, resulting in dilution.Managing equity in the restaurant sector involves understanding the financial dynamics of the industry, including high overhead costs and the need for constant innovation to remain competitive. Restaurateurs can employ strategies such as securing loans or grants to reduce reliance on equity financing, thereby protecting their ownership stakes.Additionally, forming partnerships with local suppliers or community organizations can provide alternative funding sources that dilute equity less severely, allowing owners to retain greater control over their businesses.

Small Business Equity Dilution

Small businesses also face the risk of equity dilution when seeking growth opportunities. As they look to expand, owners must be cautious about how much equity they are willing to give up in exchange for funding.Strategies for protecting equity in small businesses include exploring alternative financing options such as grants, crowdfunding, or loans that do not require issuing new shares.

Understanding the potential pitfalls associated with equity dilution, such as loss of control and reduced profits, can help small business owners make informed decisions.By maintaining a strong focus on building revenue and profitability, small businesses can minimize their reliance on external capital and the associated dilution of ownership.

Strategic Planning and Equity Dilution

Strategic planning plays a crucial role in managing equity dilution effectively. A well-thought-out business plan can help minimize dilution during funding rounds by laying out a clear path for growth and profitability.Companies should integrate dilution considerations into their strategic decisions, evaluating how each funding option will impact shareholder equity. Frameworks that prioritize long-term value creation over short-term gains can guide businesses in making strategic financial choices.By engaging stakeholders in the strategic planning process, companies can build consensus around funding strategies that align with their overall vision while protecting equity interests.

Team Building and Equity Dilution

Equity compensation can have significant effects on team dynamics and employee retention. As companies issue stock options to attract and retain talent, they must also consider how these practices impact existing shareholders.Aligning team goals with equity dilution management involves setting clear expectations around equity compensation and its potential impact on ownership. Best practices for communicating changes in equity to teams include regular updates and transparency about the company’s financial health and future plans.By fostering an open dialogue about equity changes, leaders can cultivate a culture of trust and engagement among employees, ultimately supporting the company’s long-term success.

Risk Management and Equity Dilution

Equity dilution carries inherent risks that businesses must manage to protect their interests. Understanding these risks allows companies to implement effective mitigation strategies.Risk mitigation strategies related to shareholder equity include diversifying funding sources and maintaining a disciplined approach to equity financing. By exploring a mix of debt and equity options, businesses can reduce their reliance on share issuance and the associated dilution.Examples of companies successfully managing dilution-related risks include those that prioritize sustainable growth and maintain strong investor relations, ensuring they have access to capital when needed without compromising ownership stakes.

Workplace Communication and Equity Dilution

Effective communication strategies regarding equity changes are essential for maintaining stakeholder confidence. Business leaders must be prepared to discuss dilution impacts with employees and investors in a transparent manner.Tips for discussing dilution with employees include providing context around funding decisions and how they contribute to the company’s long-term vision. Fostering open dialogue among stakeholders about equity can help build understanding and align interests.Promoting a culture of transparency around equity changes can ultimately support a more engaged workforce and a healthier business environment, enabling the company to navigate the complexities of equity dilution effectively.

Outcome Summary

In summary, navigating the complexities of equity dilution is vital for both entrepreneurs and investors. By grasping its causes, effects, and management strategies, stakeholders can make informed decisions that balance growth with shareholder interests. Ultimately, understanding equity dilution empowers businesses to innovate and thrive while maintaining a fair and transparent structure for all involved.

Question Bank

What is equity dilution?

Equity dilution occurs when a company issues new shares, reducing the ownership percentage of existing shareholders.

How does equity dilution affect existing shareholders?

It typically decreases their ownership percentage and can impact the value of their shares if the new shares do not add proportional value to the company.

Why do startups experience equity dilution?

Startups often face equity dilution during funding rounds as they issue new shares to attract investors, which is essential for growth and capital.

Can equity dilution be managed?

Yes, businesses can implement strategies to manage dilution, such as negotiating terms with investors or exploring alternative funding options.

Is equity dilution always negative?

Not necessarily; while it reduces ownership stakes, it can also provide necessary capital for growth and expansion, leading to increased overall company value.